So, whilst you might not be so interested in a news article about data theft, I bet you would be interested in anything that ensured the safety of your credit and debit cards, right?

The ABC7 I-Team, a professional investigation team from Chicago, tested a device that can "acquire" your card information secretly, say, when you are queuing up to make a payment in a store, perhaps whilst standing in an elevator or even whilst standing with others in a crowd.

And unfortunately for you and I, the test turned out to be quite "successful" anytime someone was close to the device.

David Bryan, the security specialist at Chicago's Trustwave used that device to test how it would read account numbers and expiration dates. Shockingly, he got all the information in seconds. The scanned cards would send detailed information back to the device and the whole process was invisible to the card holder.

It's a pity I didn't find video of David Bryan, but I found a quite similar one accounting for the theft clearly. Watch below for some hints.

What is even more frightening is that the device used can easily be bought online and will scan any card with the wireless symbol on it, cards with an inbuilt RFID chip.

Okay, so are you starting to get a little bit concerned?

Unfortunately, anyone with a credit card should be worried about data theft and more importantly know how to avoid it. Gone are the days where credit card fraud or identify theft was hard to do or complicated to get right. Today, credit card fraud has become a high tech business and those who are committing to it are finding it easier to do by the day.

Today, anyone with the right bit of kit can stand next to you and grab all of the confidential information in your wallet or purse without so much as lifting a finger, looking at you or even talking to you.

Now you might start to panic, thinking that the best policy is to hide somewhere no one can find you, perhaps deciding never to go out and to only ever shop online. This is not a good idea, plus you would get really lonely really quickly.

But hold on a minute, lets look at what is really happening here. The device used to scan is just an RFID scanner, right!

What is RFID?

RFID is short for Radio Frequency Identification. It uses an electromagnetic field to automatically identify and track tags attached to objects and these tags contain electronically stored information.

RFID technology has several advantages over the traditional barcode. They are able to store a lot more information, able to provide real-time information and can even be scanned from a distance and without a clear line of sight.

RFID technology has been used in many industries from banking through to retail, transportation and logistics, public transport, institutions, sports activities and so on. One great example is Walmart, they have been using RFID technology for over a decade now and it has been very beneficial in improving their inventory management, providing real-time tracking of consumer behavior and dramatically reducing the theft of in store products.

However, whilst this is great for retail store management, when you then look at how similar RFID technology has been implemented in our credit and debit cards, you can start to appreciate that identify theft has now become a very real problem.

What is an RFID enabled Credit Card?

These RFID enabled cards support a contactless data transmission method and do not require any physical contact between the card and the card reader. A contactless smart card uses the 13.56-MHz frequency spectrum and is typically the same size as a normal credit card.

These cards use the RFID radio technology to send data over a short distance through the air, through your clothing or even through your wallet. RFID chip-enabled cards are very common now and you can tell if a card is enabled because it will have a logo printed on it such as Visa Paywave, MasterCard PayPass, American Express, Discover Zip or simply a horizontal Wi-Fi style symbol.

Even though each of these banking systems offer different forms of tap-and-go technology, they all function in exactly the same way. Quite often, you will find that your local bank will offer an RFID credit or debit card supporting one of the systems mentioned above.

One reason why RFID enabled credit cards are more secure than traditional magnetic stripe cards is that the card will normally stay in the consumer's hand during the whole transaction.

And for anyone who has used an RFID enabled credit or debit card, these tend to be far more convenient and even cooler to use than older more traditional methods. Instead of swiping to pay with your traditional credit cards, all you need to do is stand near the credit card reader and wave your card at it, simple.

In Europe, the adoption of RFID enabled cards is becoming very common and widespread, which is great for the consumer and very convenient. However, in the USA, there is a much slower take up by the banks and credit cards companies and many believe that this is wrong because RFID cards should be able to reduce the amount of fraud being committed, surely?

However, as you can now appreciate with RFID cards, the problem has now become one where unless the card is protected, the data on it can be read without seeing or touching the card by anyone who has a portable RFID scanner.

RFID scanning technology makes it really easy for thieves to brush past you and steal your information and it can happen anywhere where people are present. There have even been reports of card information theft with nothing more than a smartphone and a free app.

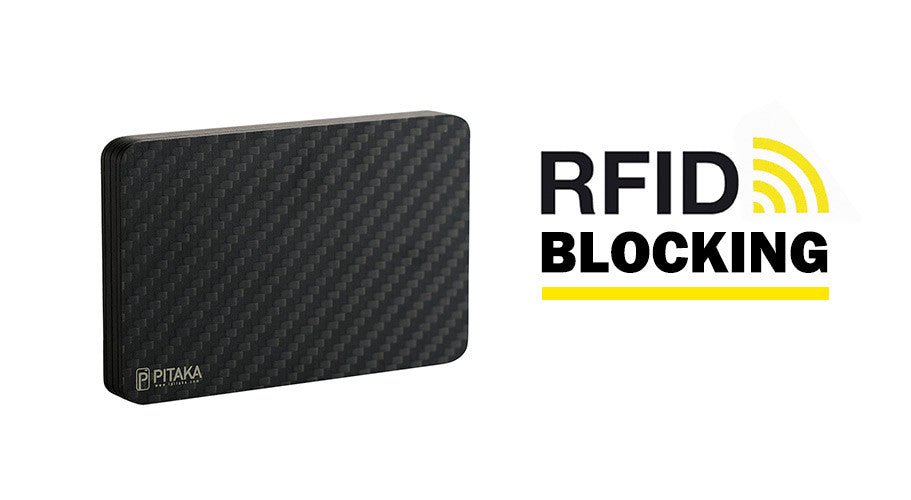

So, any RFID enabled card should be protected and an RFID-blocking wallet is the perfect solution.

What is an RFID Blocking Wallet?

When I say an 'RFID-blocking wallet', what I really mean is a portable Faraday cage that just so happens to fit into your trouser pocket. If you read one of my previous articles, "Carbon Fiber Phone Case: Just Say No", you would already be familiar with the Faraday cage phenomenon.

A Faraday cage or Faraday shield is an enclosure that is used to block electromagnetic fields and it is more often than not made from a conductive material such as carbon fiber or metal.

So, lets just look at how an RFID scanner works. The scanner sends out an electromagnetic field, which is used to 'scan' for information.

Now, in the case of our Faraday Shield, this electromagnetic field being sent out by the scanner ends up being distributed all over the exterior of our shield, which then cancels out any charge or radiation from within the shield's interior. In essence, a Faraday Shield is like a hollow conductor in which the charge remains on the external surface of the shield and never actually goes inside.

This phenomenon is often used to protect sensitive electronic equipment against external radio frequency interference.

So when a wallet is acting like a Faraday cage, your credit cards are going to be safe and sound within and no data is going to get out. Some of the most common RFID-blocking wallets are made from Carbon Fiber, Aluminum or other similar conductive materials.

To prove this, lets just see how an RFID-blocking wallet can safeguard your cards.

Do you need an RFID-blocking Wallet?

If you watched the video above, you will have seen just how good an RFID-blocking wallet is at protecting your vulnerable credit and debit cards, right?

So, the big question is, do you need an RFID-blocking wallet?

Well, if you never, ever, own a card that has an RFID chip inside it, or, maybe you don't care about identify theft, then no, you don't need one.

But, if you are one of the millions of people out there who do value their credit and debit cards and want to protect their identity, then an RFID-blocking wallet is right up your street.

And so to close, think about it this way.

As you will know from other articles, a Carbon Fiber wallet can be sleek, stylish and very durable. But it's now just got a whole lot better because it's also a superb RFID-blocking shield that will protect your valuable cards from the invisible theft out there.

You might not see the criminals coming, but your carbon fiber wallet will protect you from it, always.